Navigating the world of foreign currency exchange can be daunting, especially from Nigeria. This guide will walk you through the safest and most convenient way to buy USD online, without the pitfalls of local BDC agents, using a reliable platform.

Introduction to Buying USD Online

Buying USD online from Nigeria has become increasingly popular due to the convenience and ease it offers. With the right platforms, you can exchange your Naira for USD without the hassle of traditional banking methods or local currency exchange agents. This guide will help you understand the steps involved in purchasing USD online, ensuring a seamless experience.

Why Choose Online Currency Exchange?

- Convenience: Online currency exchange allows you to make transactions from the comfort of your home, eliminating the need to visit physical locations.

- Competitive Rates: Many online platforms offer better exchange rates compared to local banks and BDC agents.

- Quick Transactions: Transactions can be completed quickly, often within minutes, allowing for timely currency purchases.

- Flexible Payment Options: You can fund your account using various methods, including bank transfers, mobile payments, and more.

Recommended Platforms for Currency Exchange

There are several reputable platforms available for buying USD online in Nigeria. Two of the most popular options include:

- Grey.co: A well-established platform that offers competitive rates and a user-friendly interface for buying and selling foreign currencies.

- Geegpay.africa: Another reliable option that provides similar services and may offer unique features worth exploring.

Creating Your Account

The first step in purchasing USD online is to create an account on your chosen platform. This process is usually straightforward and requires you to provide some personal information.

Here’s a brief overview of what to expect during account creation:

- Visit the platform’s website and locate the registration section.

- Fill out the registration form with your details, including name, email, and phone number.

- Choose a strong password to secure your account.

Required Documents for Account Verification

To verify your account, you will need to provide specific documents. This step is crucial to ensure compliance with regulatory requirements and to protect against fraud.

- Identification: This can be your international passport, national ID number (NIN), or driver’s license.

- Bank Verification Number (BVN): Required to verify your identity and link your bank account.

- Proof of Address: A recent utility bill, bank statement, or any document that confirms your residential address.

Verification Process Timeline

Once you have submitted the required documents, the verification process typically takes between 24 to 48 hours. During this time, the platform will review your information to ensure everything is accurate and complete.

It’s advisable to prepare all necessary documents beforehand to avoid delays. Having everything ready will allow you to start trading as soon as your account is verified.

Navigating the User Interface

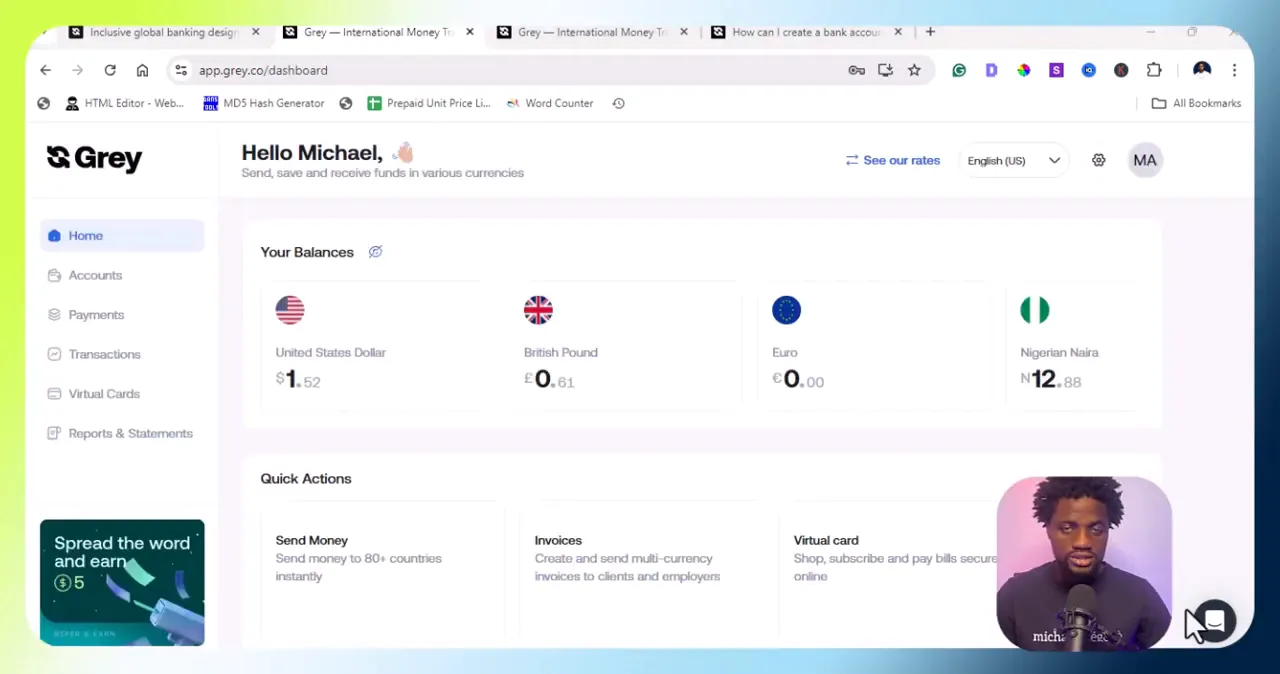

Once you log into your account, the user interface is designed to be intuitive and user-friendly. You will be greeted with a dashboard showcasing your account balances in different currencies.

At the top, you can easily switch between your Naira, USD, GBP, and Euro accounts. This seamless navigation allows you to manage multiple currencies without confusion.

Accessing Your Accounts

To access your Naira account, simply click on it. This will display your account details, including your unique account number and available balance. You will also find options to transfer funds or convert currencies.

Understanding this layout is crucial for smooth transactions. The interface is designed to minimize the steps needed to complete exchanges, making the process efficient.

Funding Your Naira Account

Funding your Naira account is the first step towards purchasing USD. You can transfer money from various sources to your Naira account using the details provided in your account dashboard.

Here’s how to fund your account:

- Using Mobile Apps: You can use any bank’s mobile app to initiate a transfer to your Naira account.

- POS Providers: If you prefer cash transactions, visit a POS provider. Hand them cash and provide your account details.

- Peer Transfers: You can also ask friends or family to send you Naira directly to your account.

Minimum Funding Requirements

It’s essential to know the minimum amount required to fund your account. Different platforms may have varying thresholds, so check the specific requirements of your chosen service.

Current Exchange Rates and Calculating Costs

Exchange rates fluctuate, and it’s vital to check the current rate before making any transactions. The platform displays real-time rates for USD against Naira, allowing you to make informed decisions.

For example, if the current rate is ₦1,665.28 for 1 USD, you can calculate the amount needed for your desired purchase easily.

Calculating Conversion Fees

When converting currencies, be aware of any conversion fees that may apply. These fees can affect the total amount you need to send to your Naira account.

To calculate your costs accurately, follow this formula:

- Determine the current exchange rate.

- Include any conversion fees in your calculations.

- Multiply the exchange rate by the amount you wish to purchase.

This way, you can ensure you are sending enough funds to cover the total cost.

Converting Naira to USD

Once your Naira account is funded, converting your funds to USD is straightforward. Here’s how to do it:

- Navigate to the “Convert Funds” section.

- Select your Naira account as the source and USD as the target currency.

- Enter the amount of Naira you wish to convert.

The platform will automatically calculate the USD equivalent, including any fees. Review the details before confirming the transaction.

Transaction Confirmation

After entering the conversion details, click on “Continue” to proceed. You will receive a confirmation screen summarizing the transaction details. Review everything carefully to ensure accuracy.

Once confirmed, the USD will reflect in your USD account almost immediately, allowing you to proceed with your online purchases.

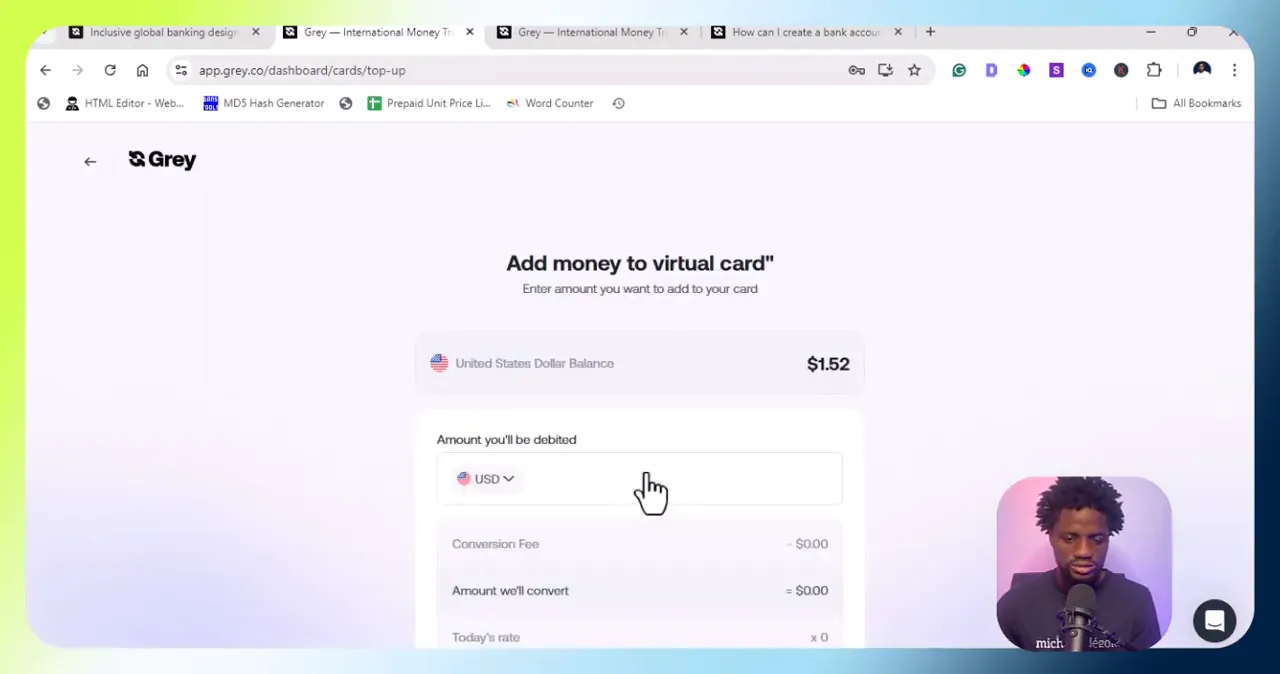

Using Virtual Cards for Online Transactions

Virtual cards provide a secure way to make online transactions using your USD balance. These cards are generated within the platform, allowing you to use them for purchases without exposing your bank details.

To use a virtual card, follow these steps:

- Navigate to the “Virtual Cards” section in your dashboard.

- Choose to add funds to your USD virtual card.

- Select the amount you wish to load onto the card.

Benefits of Using Virtual Cards

- Security: Virtual cards protect your main bank account details.

- Convenience: You can make purchases from any online store that accepts cards.

- Control: Easily manage your spending by loading only what you need onto the card.

Final Thoughts and Questions

Buying USD online from Nigeria is a simple process when you understand the steps involved. From creating your account to funding it and converting your currency, the entire experience is designed to be efficient and user-friendly.

If you have any questions or need further clarification on any of the steps, feel free to leave a comment. Your feedback is valuable, and we are here to help you navigate this process smoothly.

Don’t forget to explore different platforms to find the one that best suits your needs. Happy trading!